UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934 (Amendment No. 1)

Filed by the Registrant x Filed by a Party other than the Registrant ¨

|

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to | |

GALENA BIOPHARMA,

SELLAS LIFE SCIENCES GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other thanOther Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| ||||

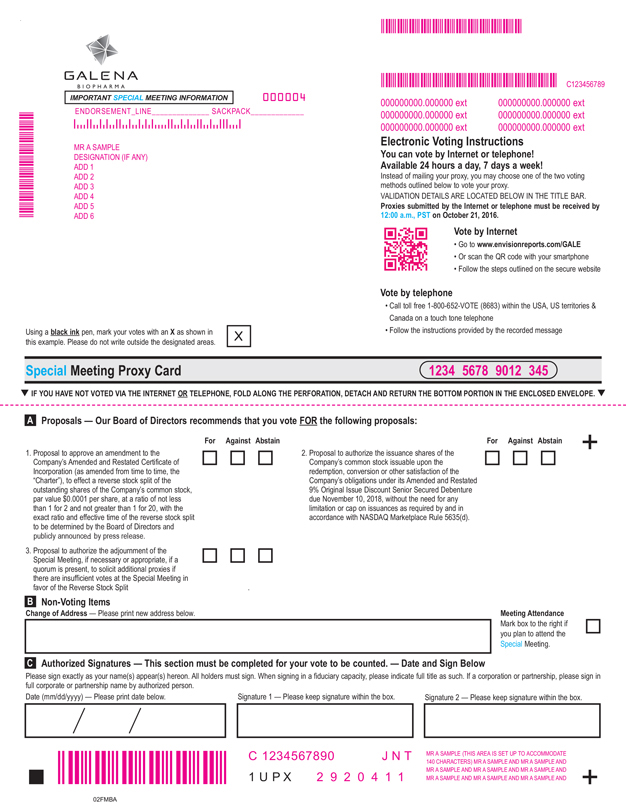

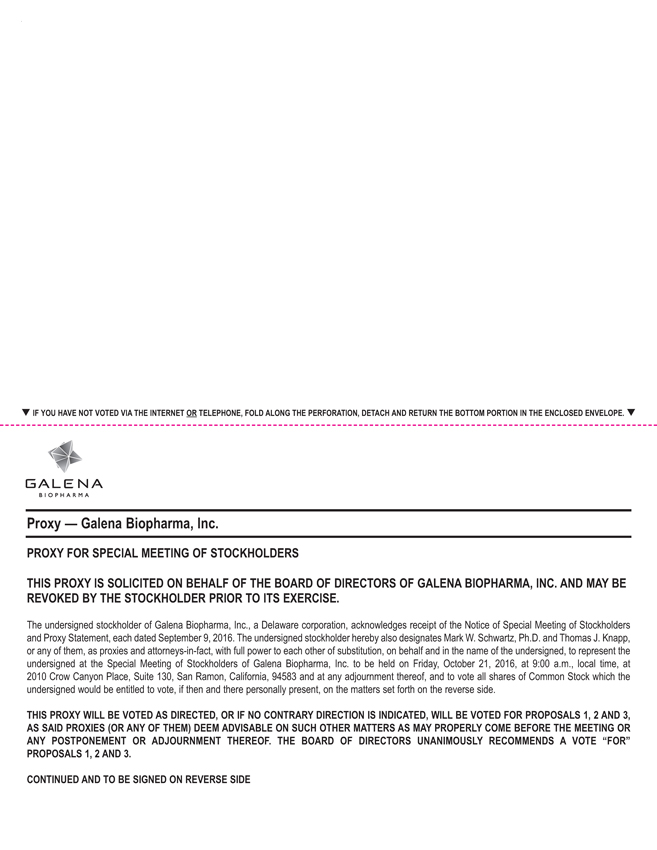

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

May 31, 2019

To Be Held on October 21, 2016Our Stockholders:

September 21, 2016

Dear Galena Biopharma Stockholder,

You are cordially invited to attend the 2019 annual meeting of stockholders of SELLAS Life Sciences Group, Inc. (the “Company”) to be held at 8:30 a.m. EDT on July 12, 2019 at 15 West 38th Street, 4th Fl., New York, NY 10018.

The enclosed Notice of Annual Meeting of Stockholders sets forth the proposals that will be presented at the Annual Meeting, which are described in more detail in the enclosed Proxy Statement. Our Board of Directors recommends that you vote “FOR” Proposals 1, 2 and 4 and “Every Year” for Proposal 3 as set forth in the Proxy Statement.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to our stockholders over the Internet unless a specialstockholder requests printed materials. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On or about May 31, 2019, we intend to begin sending to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our 2019 annual meeting of Stockholders (the “Special Meeting”)and our 2018 annual report to stockholders. The Notice also provides instructions on how to vote online or by telephone and how to receive a paper copy of Galena Biopharma, Inc., a Delaware corporation (the “Company”), whichthe proxy materials by mail.

We hope you will be held on October 21, 2016,able to attend the annual meeting. Whether you plan to attend the annual meeting or not, it is important that you cast your vote either in person or by proxy. You may vote over the Internet as well as by telephone or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in the Proxy Statement. We encourage you to vote by proxy so that your shares will be represented and voted at 9:00the meeting, whether or not you can attend.

On behalf of the Board and the management team, we thank you for your ongoing support of, and continued interest in, SELLAS.

We look forward to seeing you at the annual meeting.

| Very truly yours, | |

| |

| Angelos M. Stergiou, M.D., Sc.D. h.c. | |

| President and Chief Executive Officer |

SELLAS LIFE SCIENCES GROUP, INC.

15 West 38th Street, 10th Floor

New York, New York 10018

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

TIME: 8:30 a.m. local time, at 2010 Crow Canyon Place, Suite 130, San Ramon, CA 94583. Only stockholders whoEDT

DATE: July 12, 2019

PLACE:15 West 38th Street, 4th Fl., New York, NY 10018

PURPOSES:

| 1. | To elect one Class III director to serve on our Board of Directors for a three-year term expiring on the date on which our annual meeting of stockholders is held in 2022; |

| 2. | To approve, on an advisory basis, the compensation of our named executive officers; |

| 3. | To recommend, by non-binding vote, the frequency of future stockholder advisory votes to approve the compensation of our named executive officers; |

| 4. | To ratify the selection by our Audit Committee of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; and |

| 5. | To transact such other business as may properly come before the annual meeting and any adjournment or postponement thereof. |

WHO MAY VOTE:

You may vote if you were the record owner of the Company’s common stock at the close of business on theMay 17, 2019. A list of stockholders of record date, September 9, 2016 (the “Record Date”), may votewill be available at the Special Meeting, includingannual meeting and, during the 10 days prior to the annual meeting, at our principal executive offices located at 15 West 38th Street. 10th Floor, New York, NY 10018.

All stockholders are cordially invited to attend the annual meeting. Whether you plan to attend the annual meeting or not, we urge you to vote by following the instructions in the Notice of Internet Availability of Proxy Materials that you previously received and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any adjournment or postponement thereof.

We are holdingtime before it is voted at the Special Meeting for the following purposes, which are described in more detail in our Proxy Statement:meeting.

| |

| Barbara A. Wood | |

| Executive Vice President, General Counsel and | |

| Corporate Secretary |

New York, New York

May 31, 2019

TABLE OF CONTENTS

| Code of Ethics | 15 |

| Executive Officers | 16 |

| Biographical Information Regarding Executive Officers | 16 |

| Section 16(A) Beneficial Ownership Reporting Compliance | 16 |

| Executive Officer And Director Compensation |

We are focused on continuing to advance our existing pipeline of drug candidates including GALE-401 (Anagrelide Controlled Release) and supporting our ongoing immunotherapy programs with NeuVax™ (nelipepimut-S) and GALE-301/GALE-302. We believe GALE-401, targeting an unmet medical need, represents a potentially significant commercial opportunity with a streamlined clinical and regulatory development path. As such, we are actively preparing to advance this program into a Phase 3 Pivotal trial expected to initiate in the first half of 2017. The ongoing combination trials with NeuVax are progressing well with the presentation of safety data in our NeuVax plus trastuzumab combination trial in the HER2 1+/2+ patient population in the fourth quarter. And, we continue to evaluate the appropriate indications and patient populations to advance the asset. Additionally, we look forward to data presentations for GALE-301 this year. Corporate development activities remain a focus as we seek to expand our existing pipeline and seek partnering opportunities for our existing drug candidates that can increase shareholder value and help patients living with diseases in areas of unmet medical need.

The accompanying Proxy Statement more fully describes the details of the business to be conducted at the Special Meeting. After careful consideration, our Board of Directors has unanimously approved the proposals and recommends that you vote FOR each proposal described in the Proxy Statement. Your vote at the Special Meeting is important. Whether or not you plan to attend the Special Meeting, please vote as soon as possible by Internet, telephone or mail as described in the accompanying Proxy Statement.SELLAS LIFE SCIENCES GROUP, INC.

On behalf of our entire Board of Directors, we thank you for your continued support.15 West 38th Street, 10th Floor

Sincerely,New York, New York 10018

Mark W. Schwartz, Ph.D.

President & Chief Executive Officer

1

GALENA BIOPHARMA, INC.

2000 Crow Canyon Place, Suite 380

San Ramon, CA 94583

(925) 498-7709

PROXY STATEMENT

FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

For the Special Meeting of StockholdersFriday, July 12, 2019

To Be Held On October 21, 2016

Items of Business

This proxy statement (“Proxy Statement”)Statement, along with the accompanying notice of 2019 annual meeting of stockholders, contains information about the 2019 annual meeting of stockholders of SELLAS Life Sciences Group, Inc., including any adjournments or postponements of the annual meeting. We are holding the annual meeting at 8:30 a.m., EDT, on July 12, 2019 at 15 West 38th Street, 4th Fl., New York, NY 10018. We refer, in this Proxy Statement, to SELLAS Life Sciences Group, Inc. as “SELLAS,” “the Company,” “we” and the enclosed proxy card are being furnished in connection with“us.”

This Proxy Statement relates to the solicitation of proxies by theour Board of Directors of Galena Biopharma, Inc. (the “Company” or “Galena”) for use at the Special Meetingannual meeting.

On or about May 31, 2019, we intend to begin sending to our stockholders the Important Notice Regarding the Availability of Stockholders (“Special Meeting”) and any adjournment or postponement thereof. Your proxies will be voted in accordance with your instructions. If no choice is specified, the proxies will be voted as recommended by our Board of Directors. A stockholder who signs a proxy may revoke or revise that proxy at any time before the Special Meeting. Please see “Revocation of Proxy” below for more informationProxy Materials containing instructions on how to revoke a proxy. This Proxy Statement will be provided electronically, if elected, or otherwise is being mailed on or about September 22, 2016access our proxy statement for our 2019 annual meeting of stockholders and our 2018 annual report to stockholders of record at the close of business on September 9, 2016 (the “Record Date”).

We are holding the Special Meeting for the following purposes, which are described in more detail in this Proxy Statement:stockholders.

Record Date:QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Only those stockholders

Why is the Company Soliciting My Proxy?

Our Board of record at the close of business on September 9, 2016 are entitled to notice of andDirectors is soliciting your proxy to vote at the Special Meeting, either in person2019 annual meeting of stockholders to be held at 15 West 38th Street, 4th Fl., New York, NY 10018, on July 12, 2019, at 8:30 a.m., EDT, and any adjournments or by proxy.

There are several ways to vote. Whatever method you choose, voting in advancepostponements of the Specialmeeting, which we refer to as the annual meeting. This proxy statement, along with the accompanying Notice of Annual Meeting of Stockholders, summarizes the purposes of the meeting and the information you need to know to vote at the annual meeting.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of Annual Meeting of Stockholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 , as amended on April 30, 2019 because you owned shares of our common stock on the record date. We intend to commence distribution of theImportant Notice Regarding the Availability of Proxy Materials,which we refer to throughout this proxy statement as the Notice, and, if applicable, proxy materials to stockholders on or about May 31, 2019.

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the U.S. Securities and Exchange Commission, or the SEC, we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Stockholders will ensurenot receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the annual meeting and help to conserve natural resources. If you received the Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares will be voted as you direct, even if you do not attendby following the Special Meeting. Voting instructions are detailed on the following page and are included on the proxy card, enclosed with our Proxy Statement.in addition to the other methods of voting described in this proxy statement.

Materials:How do I attend the annual meeting?

Enclosed is our Proxy Statement as filed with the Securities and Exchange Commission (“SEC”). These materials are also available under the Investors section of our website:www.galenabiopharma.com, and the SEC’s website atwww.sec.gov, or

The annual meeting will be furnished without charge to any stockholder upon written or oral request to Galena Biopharma, Inc.held on Friday, July 12, 2019 at 8:30 a.m., Attn: Corporate Secretary, 2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583; telephone: (925) 498-7709. Information on our website is not incorporated by reference in this Proxy Statement.

2

EDT, at 15 West 38th Street, 4th Fl., New York, NY 10018. If you plan to attend the Special Meeting, Galenaannual meeting, we will have representatives will be onsite to assist with registration for the event. You must bring proof of your identity to the Special Meeting.annual meeting. If your shares are registered in the name of a bank, broker, or other holder of record, please bring both a photo ID and documentation of your stock ownership as of September 9, 2016May 17, 2019 (such as a brokerage statement).

Voting Information, Voting Securities, Quorum, and Votes Required

As a stockholder, it is very important that you vote. Please carefully review this Proxy Statement and followWho can vote at the instructions below to cast your voteannual meeting?

Only stockholders of record at the close of business on all of the proposals. As ofMay 17, 2019, or the Record Date, 214,481,939 shares of our common stock were issued and outstanding. Each share of common stock entitles the holder to one vote with respect to each matter submitted to stockholders at the Special Meeting. Stockholders do not have cumulative voting rights. We have no other securitieswill be entitled to vote at the Special Meeting.

The representation in person or by proxy of at least a majority in voting power ofannual meeting. On the Record Date, there were 25,176,475 shares of common stock issued outstanding and entitledoutstanding. Our common stock is our only class of voting stock.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the annual meeting or not, we urge you to vote at the Special Meeting is necessary to establish a quorum for the transaction of business. If a quorum isby proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not present, the meetingrevoked, will be adjourned until a quorum is obtained.

The approval ofvoted in accordance with your instructions on the Reverse Stock Split requiresproxy card or as instructed via the affirmative vote of the majority of all outstanding shares. A representative ofInternet or telephone. You may specify (i) whether your shares should be voted FOR or WITHHELD for Proposal 1, our Company will serve as the inspector of elections at the Special Meeting. The approval of the issuance of common stocknominee for the redemption and/director, (ii) whether your shares should be voted for, against or conversion of the debentureabstain with respect to Proposals 2 and warrants as described in Proposal No. 2 requires the affirmative vote of the majority of4, and (iii) whether your shares present in personshould be voted for “every year,” “every two years,” “every three years,” or represented by proxy and voting on such matters at the Special Meeting.

Shares that abstain from voting as to a particular matter will be counted for the purpose of determining whether a quorum exists. However, with respect to Proposal No. 1 – Approval of Amendment to Amended and Restated Certificate of Incorporation to Effect3. If you properly submit a Reverse Stock Split, an abstention will have the same effect as an “Against” vote. Shares held in “street name” by brokers, banks or other nominees who indicate on their proxy cards that they do not have discretionary authority to vote such shares as to a particular matter, which we refer to as “broker non-votes,” will be counted for the purpose of determining whether a quorum exists but will not have any effect upon the outcome of voting with respect to matters voted on at the Special Meeting except for Proposal No. 1 – Approval of Amendment to Amended and Restated Certificate of Incorporation to Effect a Reverse Stock Split where they will have the same effect as an “Against” vote. Brokers holding shares for clients who have not givenwithout giving specific voting instructions, are permitted to vote in their discretion only with respect to Proposal No.2 – Authorize Issuance of Common Stock for Conversion of Debenture and Proposal No.3 – Approval of Adjournment of the Special Meeting.

Stockholders may vote in person or by proxy. Voting by proxy will not in any way affect a stockholder’s right to attend the Special Meeting and vote in person. Any stockholder voting by proxy has the right to revoke the proxy at any time before the polls close at the Special Meeting by giving our corporate secretary a duly executed proxy card bearing a later date than the proxy being revoked at any time before that proxy is voted or by appearing at the Special Meeting and voting in person. The shares represented by all properly executed proxies received in time for the Special Meeting will be voted as specified. If the shares you own are held in your name and you do not specify in the otherwise properly executed proxy card how your shares are to be voted, they will be voted in accordance with our Board of Directors’ recommendations. If any other matters properly come before the meeting, the persons named in the accompanyingrecommendations as noted below. Voting by proxy intend to vote, or otherwise act, in accordance with their judgment. If the shares you own are held in “street name,” the broker, bank or other nominee, as the record holder ofwill not affect your shares, is required to vote your shares in accordance with your instructions. In order to vote your shares held in “street name,” you will need to follow the directions that your broker, bank or other nominee provides to you.

Householding

The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy delivery requirements for Special Meeting materials with respect to two or more stockholders sharing the same address by delivering a single set of Special Meeting materials addressed to those stockholders. This process, commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. Because we utilize the “householding” rules for Special Meeting materials, stockholders who share the same address will receive only one copy of the Special Meeting materials, unless we receive contrary instructions from any stockholder at that address. If you prefer to receive multiple copies of the Special Meeting materials at the same address you share with other stockholders, additional copies will be provided to you promptly upon request. If you are a stockholder of record, you may obtain additional copies at the same address you share with other stockholders by calling us at (925)

3

498-7709 or upon written request to Galena Biopharma, Inc., Attn: Corporate Secretary, 2000 Crow Canyon Place, Suite 380, San Ramon, California 94583. Eligible stockholders of record receiving multiple copies of the Special Meeting materials can request householding by contacting us in the same manner. If you are a beneficial owner and hold your shares in a brokerage or custody account, you can request additional copies of the Special Meeting materials at the same address you share with other stockholders or you can request householding by notifying your broker, bank or other nominee.

4

Voting Information

As a stockholder, it is very important that you vote. Please carefully review this Proxy Statement and follow the instructions below to cast your vote on all of the proposals.

Voter Eligibility

Only those stockholders of record at the close of business on September 9, 2016 are entitled to notice of and to vote at the Special Meeting or any postponement or adjournment thereof. A complete list of stockholders entitled to vote at the Special Meeting will be available for examination at the Special Meeting for any purpose germane to the Special Meeting.

How to Vote

Even if you planright to attend the Special Meeting, if your shares are registered directly in your name, pleaseannual meeting. You may vote right away usingby one of the following advance voting methods.Make sure to have your proxy card in hand and follow the instructions.methods:

| 1 |

|  | By | |

| By | ||

|

| By

| |

| In Person at the Meeting By Proxy or Ballot: If you attend the meeting, you may deliver a completed proxy card in person or you may vote by completing a ballot, which will be available at the meeting. As a stockholder of record, you may vote in person at the annual meeting. As a beneficial owner, since you are not the stockholder of record, you may not vote your shares in person at the annual meeting unless you request and obtain a valid proxy from your broker or other agent. |

All

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 1:00 a.m. EDT on July 12, 2019.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If on the Record Date your shares were registered directly in your name with our transfer agent, Computershare, then you are a stockholder of record. If on the Record Date your shares were not held in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name.” You must follow the instructions of the holder of record in order for your shares to be voted.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Special Meeting.annual meeting, vote by proxy using the enclosed proxy card or vote by proxy over the telephone or through the Internet. Whether or not you plan to attend the annual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the annual meeting even if you have already voted by proxy. If you attend the annual meeting and decide to vote in person even if you have already voted by proxy, you must at the annual meeting first revoke your proxy and then vote with the ballot provided to you at the annual meeting.

| 2 |

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Nominee

If you are helda beneficial owner of shares registered in “street name” forthe name of your account by a broker, bank, or other nominee, you will receiveshould have received a voting instruction form with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker, bank or other nominee. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other nominee. Follow the instructions from your broker, bank or other nominee explaining how to vote. If you plan to vote in person at the Special Meeting, you shouldincluded with these proxy materials, or contact theyour broker, bank or other nominee that holds your shares to obtain a broker’s proxy card and bring it with you to the Special Meeting. A broker’s proxy card is not the form of proxy card enclosed with this Proxy Statement. You will not be able to vote shares you hold in “street name” at the Special Meeting unless you have a proxy card from your broker issued in your name giving you the right to vote the shares.

Your proxy will be voted according to your instructions. If you do not specify how you want your shares voted, they will be voted in accordance with our Board of Directors’ recommendations.

Electronic Document Delivery

We are pleased to take advantage of SEC rules that allow companies to furnish their proxy materials over the Internet. We are mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) instead of a paper copy of our proxy materials. The Notice contains instructions on how to access those documents and to cast your vote via the Internet, as described above. The Notice also contains instructions on how to request a paper copy of our proxy material. All stockholders who do not receive a Notice will receive a paper copy of the proxy materials by mail. This process allows us to provide our stockholders with the information they need on a more timely basis, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials.

5

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider and you should read this entire Proxy Statement before voting.

|

| |

| ||

6

Proposal No. 1

Reverse Stock Split

Approval of Amendment to Amended and Restated Certificate of Incorporation to Effect a Reverse Stock Split

General

Our Board of Directors has unanimously approved, and recommended that our stockholders approve, an amendment to our Charter (the “Certificate of Amendment”), to effect a reverse stock split at a ratio of not less than1-for-2 and not greater than1-for-20, with the final decision of whether to proceed with the Reverse Stock Split, the effective time of the Reverse Stock Split, and the exact ratio of the Reverse Stock Split to be determined by the Board of Directors, in its discretion. If the stockholders approve the Reverse Stock Split, and the Board of Directors decides to implement it, the Reverse Stock Split will become effective as of 12:01 a.m. Eastern Time on a date to be determined by the Board that will be specified in the Certificate of Amendment. If the Board of Directors does not decide to implement the Reverse Stock Split within twelve months from the date of the Special Meeting, the authority granted in this proposal to implement the reverse stock split will terminate.

The Reverse Stock Split will be realized simultaneously for all outstanding common stock, options to purchase shares of our common stock (including shares available for future grants under the 2016 Incentive Plan), and warrants to purchase shares of our common stock. The Reverse Stock Split will affect all holders of common stock uniformly and each stockholder will hold the same percentage of common stock outstanding immediately following the Reverse Stock Split as that stockholder held immediately prior to the Reverse Stock Split, except for immaterial adjustments that may result from the treatment of fractional shares as described below. The Reverse Stock Split will not change the par value of our common stock and will not reduce the number of authorized shares of common stock.

If we fail to obtain stockholder approval of either Proposal No.1 or Proposal No.2 (described in the next section) at the Special Meeting, we intend to continue to seek to obtain stockholder approval at each subsequent annual meeting of stockholders and/or special meetings of stockholders until such approval has been obtained and we will incur the costs associated therewith.

Reasons for the Reverse Stock Split

Retain Listing on the NASDAQ Capital Market

The principal reason for the reverse stock split is the continued listing on The NASDAQ Capital Market by increasing the per share trading price of the Company’s common stock in order to help ensure a share price high enough to satisfy the $1.00 per share minimum bid price requirement, although there can be no assurance that the trading price of our common stock would be maintained at such level or that we will be able to maintain the listing of our common stock on The NASDAQ Capital Market under the ticker symbol “GALE”.

As previously reported, on August 11, 2016, the Company received written notice (the “Notification Letter”) from the NASDAQ Stock Market (“NASDAQ”) notifying the Company that it was not in compliance with the minimum bid price requirements set forth in NASDAQ Listing Rule 5550(a)(2) for continued listing on The NASDAQ Capital Market, because the bid price of the Company’s common stock had closed below the minimum $1.00 per share for the 30 consecutive business days prior to the date of the Notification Letter. NASDAQ stated in its August 11th letter that, in accordance with Marketplace Rule 5810(c)(3)(A), we have been provided a grace period of 180 calendar days, or until February 7, 2017, in which to regain compliance with the minimum consolidated closing bid price requirement for continued listing. Compliance will be regained if our consolidated closing bid price is at or above $1.00 for at least 10 consecutive trading days anytime during the 180-day period.

The Board of Directors believes that maintaining the listing of our common stock on the NASDAQ Capital Market is in the Company’s best interests and the best interests of our stockholders. The Board of Directors has considered the potential harm to the Company and our stockholders should NASDAQ delist our common stock. Delisting from NASDAQ would significantly affect the ability of investors to trade our securities and would likely adversely affect our ability to raise additional financing through the public or private sale of equity securities. Delisting would also likely negatively affect the value and liquidity of our common stock because alternatives, such as the OTC Bulletin Board and the pink sheets, are generally considered to be less efficient markets.

We believe that the decrease in the number of shares of our outstanding common stock as a consequence of the Reverse Stock Split, and the anticipated increase in the price per share, is necessary to ensure that we retain listing on the NASDAQ Capital Market as well as encouraging greater interest in our common stock by the financial community, business development partners and the investing

7

public. We believe it will also help us attract and retain employees and other service providers, help us raise additional capital through the sale of stock in the future if needed, and possibly promote greater liquidity for our stockholders with respect to those shares presently held by them.

We believe that the Company’s best option to meet NASDAQ’s $1.00 minimum bid price requirement of Marketplace Rule 5810(c)(3)(A) may be to effect the Reverse Stock Split to increase the per share trading price of our common stock. The volatility and fluctuations in the capital markets combined with the potential news items related to clinical and operational updates, may not increase our stock price by a sufficient amount to meet the NASDAQ listing requirements within the 180-day grace period without the Reverse Stock Split.

Marketability

In addition, we believe that the low per share market price of our common stock impairs its marketability to and acceptance by institutional investors and other members of the investing public and creates a negative impression of the Company. Many investors, brokerage firms and market makers consider low priced stocks as unduly speculative in nature and, as a matter of policy, avoid investment and trading in such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. The presence of these factors may adversely affect not only the pricing of our common stock but also its trading liquidity. In addition, these factors may affect our ability to raise additional capital through the sale of stock.

Because of the trading volatility often associated with low-priced stocks, many brokerage firms and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices pertain to the payment of brokers’ commissions and to time-consuming procedures that function to make the handling of lower-priced stocks unattractive to brokers from an economic standpoint. Additionally, because brokers’ commissions on lower-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current share price of the common stock can result in an individual stockholder paying transaction costs that represent a higher percentage of total share value than would be the case if our share price were substantially higher. This factor may also limit the willingness of institutions to purchase our common stock. The Board of Directors believes that the anticipated higher market price resulting from a Reverse Stock Split could enable institutional investors and brokerage firms with such policies and practices to invest or handle trading in our common stock, but there can be no assurance that the Reverse Stock Split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks.

We believe that our current low stock price may prevent or discourage investment in our pipeline programs. We are focused on continuing to advance our existing pipeline of drug candidates including GALE-401 (Anagrelide Controlled Release) and supporting our ongoing immunotherapy programs with NeuVax™ (nelipepimut-S) and GALE-301/GALE-302. We believe GALE-401, targeting an unmet medical need, represents a potentially significant commercial opportunity with a streamlined clinical and regulatory development path. As such we are actively preparing to advance this program into a Phase 3 Pivotal trial expected to initiate in the first half of 2017. The ongoing combination trials with NeuVax are progressing well with the presentation of safety data in our NeuVax plus trastuzumab combination trial in the HER2 1+/2+ patient population in the fourth quarter. And, we continue to evaluate the appropriate indications and patient populations to advance the asset. Additionally, we look forward to data presentations for GALE-301 this year. Corporate development activities remain a focus as we seek to expand our existing pipeline and seek partnering opportunities for our existing drug candidates that can increase shareholder value and help patients living with diseases in areas of unmet medical need.

Further, we believe that a higher stock price could help us establish business development relationships with other companies. We believe that potential business development partners may be less confident in the prospects of a company with a low stock price, and are less likely to enter into business relationships with a company with a low stock price. If the Reverse Stock Split successfully increases the per share price of our common stock, we believe this may increase our ability to attract business development partners. Also, we believe that strategic transactions are more likely without a low stock price. With a successful reverse stock split, in theory, we may be more successful in engaging in strategic transactions including mergers and acquisitions.

We further believe that a higher stock price could help us attract and retain employees and other service providers. We believe that some potential employees and service providers are less likely to work for a company with a low stock price, regardless of the size of the company’s market capitalization.

With shares trading at a higher price, it may promote greater liquidity for our stockholders with respect to those shares presently held by them. However, the possibility also exists that liquidity may be adversely affected by the reduced number of shares which would be outstanding if the Reverse Stock Split is effected, particularly if the price per share of our common stock begins a declining trend after the Reverse Stock Split is effected.

8

If Proposal No. 1 is not approved by our stockholders and implemented, approval by our stockholders of this Proposal No. 2 will have no effect as we will not have enough authorized shares to accommodate the monthly redemptions, conversion of the Debenture or exercise of the Warrants, as applicable, and because we would not have obtained the required Stockholder Approval (described below).

The Board of Directors believes that stockholder adoption of a range of Reverse Stock Split ratios (as opposed to adoption of a single reverse stock split ratio or a set of fixed ratios) provides maximum flexibility to achieve the purposes of a reverse stock split and, therefore, is in the best interests of the Company. In determining a ratio following the receipt of stockholder adoption, the Board of Directors (or any authorized committee of the Board of Directors) may consider, among other things, factors such as:

The Board of Directors (or any authorized committee of the Board of Directors) reserves the right to elect to abandon the Reverse Stock Split, notwithstanding stockholder adoption thereof, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the Company.

Reverse Stock Split Amendment to the Charter

If the Reverse Stock Split is approved, Article III, Section A of the Charter is amended and restated in its entirety as follows:

“A.Classes of Stock.This Corporation is authorized to issue [●] shares, of which [●] shall be Common Stock with a par value of $0.0001 per share (the “Common Stock”) and [5,000,000] shares shall be Preferred Stock with a par value of $0.0001 per share.

Reverse Stock Split.Effective at 12:01 a.m., Eastern [Daylight Savings] Time on [●] [●], 2016 this Certificate of Amendment of the Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware (the “Split Effective Time”), the shares of Common Stock issued and outstanding immediately prior to the Split Effective Time and the shares of Common Stock issued and held in the treasury of the Corporation immediately prior to the Split Effective Time are reclassified into a smaller number of shares such that each two to twenty shares of issued Common Stock immediately prior to the Split Effective Time is reclassified into one share of Common Stock, the exact ratio within the two to twenty range to be determined by the board of directors of the Corporation prior to the Split Effective Time and publicly announced by the Corporation. Notwithstanding the immediately preceding sentence, no fractional shares shall be issued and, in lieu thereof, upon surrender after the Split Effective Time of a certificate which formerly represented shares of Common Stock that were issued and outstanding immediately prior to the Split Effective Time, any person who would otherwise be entitled to a fractional share of Common Stock as a result of the reclassification, following the Split Effective Time, shall be entitled to receive a cash payment equal to the fraction to which such holder would otherwise be entitled multiplied by the closing price of a share of Common Stock on the NASDAQ Capital Market immediately following the Split Effective Time.

Each stock certificate that, immediately prior to the Split Effective Time, represented shares of Common Stock that were issued and outstanding immediately prior to the Split Effective Time shall, from and after the Split Effective Time, automatically and without the necessity of presenting the same for exchange, represent that number of whole shares of Common Stock after the Split Effective Time into which the shares of Common Stock formerly represented by such certificate shall have been reclassified (as well as the right to receive cash in lieu of fractional shares of Common Stock after the Split Effective Time).”

The Certificate of Amendment attached hereto asAnnex Areflects the changes that will be implemented to our Charter if the Reverse Stock Split is approved.

Principal Effects of the Reverse Stock Split

If the stockholders approve the proposal to authorize the Board of Directors to implement the Reverse Stock Split and the Board of Directors implements the Reverse Stock Split, we will amend the existing provision of Article III of our Charter in the manner set forth above.

By approving this amendment, stockholders will approve the combination of any whole number of shares of common stock between and including two (2) and twenty (20), with the exact number to be determined by the Board of Directors, into one (1) share. The Certificate of Amendment to be filed with the Secretary of State of the State of Delaware will include only that number determined by the Board of Directors to be in the best interests of the Company and its stockholders.

9

In accordance with these resolutions, the Board of Directors will not implement any amendment providing for a different split ratio.

As explained above, the Reverse Stock Split will be effected simultaneously for all issued and outstanding shares of common stock and the exchange ratio will be the same for all issued and outstanding shares of common stock. The Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company, except to the extent that the Reverse Stock Split results in any of our stockholders receiving a cash payment in lieu of owning a fractional share, as described in the section titled “Fractional Shares,” below. Common stock issued pursuant to the Reverse Stock Split will remain fully paid andnon-assessable. The Reverse Stock Split will not affect the Company’s continuing obligations under the periodic reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Following the Reverse Stock Split, our common stock will continue to be listed on The NASDAQ Capital Market, under the symbol “GALE,” although it would receive a new CUSIP number.

Upon effectiveness of the Reverse Stock Split, the number of authorized shares of common stock that are not issued or outstanding will increase because the proposed amendment will not reduce the number of authorized shares, while it will reduce the number of outstanding shares by a factor of between and including two and twenty, depending on the exchange ratio selected by the Board of Directors.

The shares that are authorized but unissued after the Reverse Stock Split will be available for issuance, and, if we issue these shares, the ownership interest of holders of our common stock will be diluted. We may issue such shares to raise capital and/or as consideration in acquiring other businesses, assets, or establishing strategic relationships with other companies. Such acquisitions or strategic relationships may be effected using shares of common stock or other securities convertible into common stock and/or by using capital that may need to be raised by selling such securities. We do not have any agreement, arrangement or understanding at this time with respect to any specific acquisition for which the newly unissued authorized shares would be issued.

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates

If the Reverse Stock Split is approved by the Company’s stockholders, and if at such time the Board of Directors still believes that a Reverse Stock Split is in the best interests of the Company and its stockholders, the Board of Directors will determine the ratio of the Reverse Stock Split to be implemented. The Reverse Stock Split will become effective as of 12:01 a.m. Eastern Time on the date specified in the Certificate of Amendment as filed with the office of the Secretary of State of the State of Delaware (the “effective time”). The Board of Directors will determine the exact timing of the filing of the Certificate of Amendment based on its evaluation as to when the filing would be the most advantageous to the Company and its stockholders and publicly announced in a press release. If the Board of Directors does not decide to effect the Reverse Stock Split within twelve months from the date of the Special Meeting, the authority granted in this proposal to effect the Reverse Stock Split will terminate.

Except as described below under the section titled “Fractional Shares,” at the effective time, each whole number of issued and outstandingpre-reverse split shares that the Board of Directors has determined will be combined into onepost-reverse split share, will, automatically and without any further action on the part of our stockholders, be combined into and become one share of common stock, and each certificate which, immediately prior to the effective time representedpre-reverse stock split shares, will be deemed for all corporate purposes to evidence ownership ofpost-reverse split shares.

Fractional Shares

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders of record at the effective time of the Reverse Stock Split who otherwise would be entitled to receive fractional shares because they hold a number ofpre-split shares not evenly divisible by the number ofpre-split shares for which eachpost-split share is to be exchanged, will, in lieu of a fractional share, be entitled, upon surrender to the exchange agent of certificate(s) representing suchpre-split shares, to a cash payment in lieu thereof. The cash payment will equal the fraction to which the stockholder would otherwise be entitled multiplied by the average of the closing prices (as adjusted to reflect the Reverse Stock Split) of our common stock, as reported by NASDAQ Capital Markets, during the ten consecutive trading days ending on the trading day that is the second day immediately prior to the date on which the Reverse Stock Split becomes effective.

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, sums due for fractional interests that are not timely claimed after the effective time may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

10

Risks Associated with the Reverse Stock Split

We cannot predict whether the Reverse Stock Split will result in an increase in the market price for our common stock over an extended period of time. The history of similar stock split combinations for companies in like circumstances is varied, and the market price of our common stock will also be based on our performance and other factors most of which are unrelated to the number of shares outstanding. Further, there are a number of risks associated with the Reverse Stock Split, including:

Additional negative consequences of failing to obtain stockholder approval of either Proposal No. 1 or Proposal No.2 are set forth in the section for Proposal No.2, under the heading “Potential Consequences if Proposal No.1 or Proposal No. 2 are Not Approved.”

Effect on Beneficial Holders of Common Stock (i.e., stockholders who hold in “street name”)

Upon the effectiveness of the Reverse Stock Split, we intend to treat shares of common stock held by stockholders in “street name,” through a bank, broker or other nominee, in the same manner as registered stockholders whose shares of common stock are registered in their names. Banks, brokers or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding the common stock in “street name.” However, these banks, brokers or other nominees may have different procedures than

11

registered stockholders for processing the Reverse Stock Split and making payment for fractional shares. If a stockholder holds shares of common stock with a bank, broker or other nominee and has any questions in this regard, stockholders are encouraged to contact their bank, broker or other nominee.

Beneficial Ownership of Galena’s Common Stock

The following table sets forth information with respect to the beneficial ownership of our common stock as of September 9, 2016, by:

Beneficial ownership is determined in accordance with SEC rules, and generally includes voting or investment power with respect to securities. Shares of common stock subject to options, warrants and convertible securities that are exercisable or convertible within 60 days are deemed to be outstanding and to be beneficially owned by the person holding the options, warrants or convertible securities for the purpose of computing the percentage ownership of the person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Unless otherwise noted, the information below is based on the number of shares of our common stock beneficially owned by each person or entity at September 9, 2016 and the number of shares subject to any options and warrants granted to these individuals that are exercisable within 60 days of September 9, 2016, which are indicated by footnote. The percentage ownership is based on 214,481,939 shares of common stock outstanding as of September 9, 2016. An asterisk (*) denotes beneficial ownership of less than 1%.

12

| Amount and Nature of Beneficial | ||||||||

| Name of Beneficial Owner | Ownership | Percentage | ||||||

Named Executive Officers and Directors: | ||||||||

Mark W. Schwartz, Ph.D.(1) | 1,978,883 | * | ||||||

John T. Burns (2) | 72,148 | |||||||

Thomas Knapp (3) | 68,125 | * | ||||||

Bijan Nejadnik (4) | 105,378 | |||||||

Richard Chin, M.D.(3) | 237,500 | * | ||||||

Irving M. Einhorn(3) | 225,000 | * | ||||||

Stephen S. Galliker(5) | 335,000 | * | ||||||

Sanford J. Hillsberg(6) | 478,421 | * | ||||||

William L. Ashton(3) | 225,000 | * | ||||||

Rudolph Nisi, M.D.(7) | 448,500 | * | ||||||

Mary Ann Gray, Ph.D. (8) | 164,938 | * | ||||||

| All executive officers and directors as a group — 11 persons(9) | 4,338,893 | 2.02% | ||||||

Name and address of 5% Beneficial Owner: | ||||||||

Sabby Management, LLC(10) | ||||||||

10 Mountainview Road, Suite 205 | 14,000,200 | 6.53% | ||||||

Upper Saddle River, New Jersey 07458 | ||||||||

CVI Investments, Inc.(11) | ||||||||

P.O. Box 309GT | ||||||||

Ugland House, South Church Street | 14,000,000 | 6.53% | ||||||

George Town, Grand Kayman | ||||||||

KY1-1104, Cayman Islands | ||||||||

13

Effect onBook-Entry Shares (i.e., stockholders that are registered on the transfer agent’s books and records but do not hold certificates)

If the Reverse Stock Split is effected, stockholders who hold uncertificated shares (i.e., shares held inbook-entry form and not represented by a physical stock certificate), either as direct or beneficial owners, will have their holdings electronically adjusted automatically by our transfer agent (and, for beneficial owners, by their brokers or banks that hold in “street name” for their benefit, as the case may be) to give effect to the Reverse Stock Split. Stockholders who hold uncertificated shares as direct owners will be sent a statement of holding from our transfer agent that indicates the number ofpost-reverse stock split shares of our common stock owned inbook-entry form.

Effect on Certificated Shares

As soon as practicable after the effective time of the Reverse Stock Split, stockholders will be notified that the Reverse Stock Split has been effected. We expect that our transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates. Holders ofpre-split shares will be asked to surrender to the exchange agent certificates representingpre-split shares in exchange for certificates representingpost-split shares in accordance with the procedures to be set forth in a letter of transmittal to be sent by us or our exchange agent. No new certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent. Anypre-split shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged forpost-split shares.STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Principal Effects of Reverse Stock Split on Outstanding Options, Warrants, and Option Plan

As of the Record Date, there were outstanding stock options to purchase an aggregate of 10,554,697 shares of our common stock with a weighted average exercise price of $2.29 per share, and warrants to purchase an aggregate of 37,418,263 shares of common stock with a weighted average exercise price of $1.82 per share. When the Reverse Stock Split becomes effective, the number of shares of common stock covered by such rights will be reduced to between and including one-half and one-twentieth the number currently covered, and the exercise or conversion price per share will be increased by between and including two and twenty times the current exercise or conversion price, resulting in the same aggregate price being required to be paid upon exercise or conversion thereof as was required immediately preceding the Reverse Stock Split.

In addition, the number of shares of common stock and number of shares of common stock subject to stock options or similar rights authorized under the Company’s equity incentive plan and employee stock purchase plan will automatically be proportionately adjusted for the reverse stock split ratio, such that fewer shares will be subject to such plans. Further, the per share exercise price under such plans will automatically be proportionately adjusted for the reverse stock split.

As an example, the following table illustrates the effects of a 1-for-10 Reverse Stock Split, without giving effect to any adjustments for fractional shares of our outstanding common stock, options to purchase our common stock or outstanding warrants to purchase our common stock as of September 9, 2016:

14

| Prior to Reverse Stock Split | After 1 for 10 Reverse Stock Split | |||||||

Common Stock: | ||||||||

Outstanding | 214,481,939 | 21,448,193 | ||||||

Issuable pursuant to outstanding equity awards | 10,554,697 | 1,055,469 | ||||||

Reserved for future issuance under 2016 Incentive Plan | 10,667,630 | 1,066,763 | ||||||

Issuable pursuant to outstanding warrants to purchase common stock | 37,418,263 | 3,741,826 | ||||||

Accounting Matters

The Reverse Stock Split will not affect the common stock capital account on our balance sheet. However, because the par value of our common stock will remain unchanged at the effective time of the split, the components that make up the common stock capital account will change by offsetting amounts. Depending on the size of the Reverse Stock Split the Board of Directors decides to implement, the stated capital component will be reduced proportionately based upon the Reverse Stock Split and the additionalpaid-in capital component will be increased with the amount by which the stated capital is reduced. Immediately after the Reverse Stock Split, the per share net income or loss and net book value of our common stock will be increased because there will be fewer shares of common stock outstanding. All historic share and per share amounts in our financial statements and related footnotes will be adjusted accordingly for the Reverse Stock Split.

Effect on Par Value

The proposed amendment to our Charter will not affect the par value of our common stock, which will remain at $0.0001 per share.

No Going Private Transaction

Notwithstanding the decrease in the number of outstanding shares following the proposed Reverse Stock Split, our Board of Directors does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule13e-3 of the Exchange Act.

PotentialAnti-Takeover Effect

Although the increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have ananti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of the Board of Directors or contemplating a tender offer or other transaction for the combination of the Company with another company), the Reverse Stock Split proposal is not being proposed in response to any effort of which we are aware to accumulate shares of our common stock or obtain control of the Company, nor is it part of a plan by management to recommend a series of similar amendments to the Board of Directors and stockholders. Other than the Reverse Stock Split proposal, the Board of Directors does not currently contemplate recommending the adoption of any other actions that could be construed to affect the ability of third parties to take over or change control of the Company.

No Dissenters’ Appraisal Rights

Under the Delaware General Corporation Law, the Company’s stockholders are not entitled to dissenters’ appraisal rights with respect to the Reverse Stock Split, and the Company will not independently provide stockholders with any such right.

Material United States Federal Income Tax Consequences of the Reverse Stock Split

The following is not intended as tax or legal advice. Each holder should seek advice based on his, her or its particular circumstances from an independent tax advisor.

The following is a summary of certain United States federal income tax consequences of the Reverse Stock Split generally applicable to beneficial holders of shares of our common stock. This summary addresses only such stockholders who hold theirpre-reverse stock

15

split shares as capital assets and will hold thepost-reverse stock split shares as capital assets. This discussion does not address all United States federal income tax considerations that may be relevant to particular stockholders in light of their individual circumstances or to stockholders that are subject to special rules, such as financial institutions,tax-exempt organizations, insurance companies, dealers in securities, and foreign stockholders. The following summary is based upon the provisions of the Internal Revenue Code of 1986, as amended, applicable Treasury Regulations thereunder, judicial decisions and current administrative rulings, as of the date hereof, all of which are subject to change, possibly on a retroactive basis. Tax consequences under state, local, foreign, and other laws are not addressed herein. Each stockholder should consult its tax advisor as to the particular facts and circumstances, which may be unique to such stockholder and also as to any estate, gift, state, local or foreign tax considerations arising out of the Reverse Stock Split.

Exchange Pursuant to Reverse Stock Split

No gain or loss will be recognized by a stockholder upon such stockholder’s exchange ofpre-Reverse Stock Split shares forpost-Reverse Stock Split shares pursuant to the Reverse Stock Split, except to the extent of cash, if any, received in lieu of fractional shares, further described in “Cash in Lieu of Fractional Shares” below. The aggregate tax basis of thepost-Reverse Stock Split shares received in the Reverse Stock Split, including any fractional share deemed to have been received, will be equal to the aggregate tax basis of thepre-Reverse Stock Split shares exchanged therefor, and the holding period of thepost-Reverse Stock Split shares will include the holding period of thepre-Reverse Stock Split shares.

Cash in Lieu of Fractional Shares

A holder ofpre-Reverse Stock Split shares that receives cash in lieu of a fractional share ofpost-Reverse Stock Split shares should generally be treated as having received such fractional share pursuant to the Reverse Stock Split and then as having exchanged such fractional share for cash in a redemption by the Company. The amount of any gain or loss should be equal to the difference between the ratable portion of the tax basis of thepre-Reverse Stock Split shares exchanged in the Reverse Stock Split that is allocated to such fractional share and the cash received in lieu thereof. In general, any such gain or loss will constitute a long-term capital gain or loss if the holder’s holding period for suchpre-Reverse Stock Split shares exceeds one year at the time of the Reverse Stock Split. Deductibility of capital losses by holders is subject to limitations.

Interests of Directors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent of their ownership of shares of our common stock.

Reservation of Right to Abandon Reverse Stock Split

We reserve the right to not file the Certificate of Amendment and to abandon any reverse stock split without further action by our stockholders at any time before the effectiveness of the filing with the Secretary of the State of Delaware of the Certificate of Amendment, even if the authority to effect these amendments is approved by our stockholders at the Special Meeting. By voting in favor of Reverse Stock Split, you are expressly also authorizing the Board of Directors to delay, not proceed with, and abandon, these proposed amendments if it should so decide, in its sole discretion, that such action is in the best interests of our stockholders.

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to vote on the matter either in person or by proxy is required to approve the Certificate of Amendment to our Charter to effect the Reverse Stock Split of our common stock. Abstentions and brokernon-votes, if any, will thus count as votes AGAINST the Reverse Stock Split.

Holders of proxies solicited by this Proxy Statement will vote the proxies received by them as directed on the proxy card or, if no direction is made, then FOR the Reverse Stock Split.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE AMENDMENT OF OUR CHARTER TO EFFECT THE REVERSE STOCK SPLIT.

16

Proposal No. 2

Approval of Issuance of Common Stock for Redemption and/or Conversion of Debenture

Reasons for Proposal

In May 2016, we secured a debt financing with JGB (Cayman) Newton Limited (“JGB”) with terms that included a 6.375% original issue discount, a 9% Senior Secured Debenture due November 10, 2018 (as amended, “Debenture”). We amended the Debenture in August 2016 to allow us to repay the Debenture under certain conditions with our common stock and allow the holder of the Debenture to convert some or all of the Debenture into stock under certain conditions. The flexibility to repay this Debenture in either cash or shares of our common stock, together with other financing facilities we have established, provide us with the necessary means to fund our operations. If we decide to pay the Debenture in shares and/or the holder of the Debenture decides to convert the Debenture into our common stock, we may not issue to the holder of the Debenture more than 36,185,586 shares, which represented 19.99% of our outstanding shares of common stock on the date the Debenture was originally issued, without first obtaining stockholder approval. As a result, we are seeking to obtain the requisite stockholder approval to authorize the issuance of shares of our common stock equal to 20% or more of our common stock or 20% or more of our voting power outstanding prior to the sale for less than the greater of book or market value of the stock (the “20% Cap”) to allow us to make the monthly redemptions in shares of our common stock, allow JGB to equitize some or all of the Debenture through a conversion of the outstanding balance of the debt, or allow the issuance of shares upon the exercise by JGB of the warrants.

Our Board of Directors has determined that it is in the best interest of the Company, and in the best interest of our stockholders, to have the ability to issue shares of our common stock in excess of 19.99% of the outstanding shares to allow us to redeem the Debenture by delivering our common stock to the holder of the Debenture and/or the holder to convert the Debenture into our common stock as well as to exercise the warrants whereby reducing the amount of cash necessary to redeem the Debenture over the term of the Debenture.

Our common stock is listed on the NASDAQ Capital Market and we are subject to the NASDAQ Marketplace Rules. NASDAQ Marketplace Rule 5635(d) is commonly referred to as the “NASDAQ 20% Rule.” The NASDAQ 20% Rule requires that a listed company obtain stockholder approval prior to certain issuances of common stock or securities convertible into or exchangeable for common stock at a price less than the greater of market price or book value of common stock. On May 8, 2016, the day before the original issuance date of the Debenture, our common stock had a book value of $0.56 and a market price of $1.25. Because the conversion and redemption prices applicable to the Debenture are or may be less than such amounts, we cannot issue more shares than the 20% Cap unless our stockholders first approve such issuances.

We are seeking stockholder approval to make such issuances of our common stock described above in accordance with Rule 5635 so that we can make as many monthly redemptions of the Debenture with shares of our common stock as we deem appropriate and the Debenture holder can convert some or all of the outstanding balance of the Debenture and obtain shares of our common stock upon the exercise of the Warrants.

As of the record date for the Special Meeting, we have 214,481,939 shares of our common stock issued and outstanding. Based on the current terms of the Debenture and the requirement that the minimum volume-weighted average price of our common stock is not less than $0.20, but disregarding the 20% Cap, we could potentially issue up to a maximum of 138,000,000 shares of our common stock upon redemptions of principal only of the Debenture, which amount would represent 39% of our total outstanding common stock following the issuance of such maximum based on our current outstanding common stock. Accordingly, if this Proposal No. 2 is approved our stockholders may experience significant additional dilution in the event we issue shares of our common stock upon redemptions or conversions of the Debenture in excess of the 20% Cap to which we are currently subject. Such additional dilution would afford our current stockholders a smaller percentage interest in the voting power, liquidation value and aggregate book value of the Company. Additionally, the resale of the shares of our common stock issued in satisfaction of the Debenture into the public markets could cause the market price of our common stock to decline.

Our Board of Directors believes approval of Proposal No. 2 is in the best interests of our Company and our stockholders because it will provide us additional flexibility to determine whether or not to satisfy redemptions and conversions of the Debenture in shares of our common stock or in cash. If Proposal No. 2 is not approved by our stockholders, then we will be limited to issuing a maximum of 36,185,586 shares of our common stock in satisfaction of the Debenture. Any additional payment obligations would need to be satisfied in cash. In order to generate the cash needed to satisfy redemptions of the Debenture, we would likely need to sell shares of our common stock in separate private placements or public offerings, which may be difficult to complete or may need to be completed at times or prices when the market conditions for our common stock are poor. If we are not able to generate the cash needed to satisfy our obligations under the Debenture and do not then have sufficient unrestricted cash to pay redemptions under the Debenture, then we may be forced to default under the Debenture if we have then issued shares up to the 20% Cap. Accordingly, approval of Proposal No. 2 will afford us with significant flexibility to meet our obligations under the Debenture and preserving our cash resources for our planned operating activities.

If Proposal No. 1 is not approved by our stockholders and implemented, approval by our stockholders of this Proposal No. 2 will have no effect as we will not have enough authorized shares to accommodate the monthly redemptions, conversion of the Amended Debenture or exercise of the Warrants, as applicable, and because we would not have obtained the required Stockholder Approval (described above). If Proposal No. 2 is not approved by our stockholders, then we may not issue upon redemption, conversion or otherwise in satisfaction of our obligations under the Debenture more shares than the 20% Cap.

Background; Terms of the Debenture and the Warrants

On May 10, 2016, the Company and JGB (Cayman) Newton Ltd. (the “Purchaser”) entered into a Securities Purchase Agreement (the “Purchase Agreement”) pursuant to which the Company sold and issued to the Purchaser, at a 6.375% original issue discount, a 9% Senior Secured Debenture due November 10, 2018 and having a principal face amount of $25,530,000, and warrants to purchase up to 2,000,000 shares of the Company’s common stock (the “Warrants”). On August 22, 2016, the Company, the Purchaser and certain other parties entered into an Amendment Agreement (the “Amendment Agreement”), which provides for the amendment and restatement of such debenture (as amended, the “Debenture”), an amendment to the terms of the Series A Common Stock Purchase Warrant issued by the Company to the Purchaser pursuant to the terms of the Purchase Agreement, and certain other terms and conditions, as summarized below.

17

Net proceeds to the Company from sale of the Debenture, after payment of commissions and legal fees, were approximately $23,400,000. The Debenture matures November 10, 2018, accrue interest at 9% per year, and does contain a conversion feature into shares of our common stock. The Company intends to use the net proceeds from this offering to fund the costs associated with our GALE-401 clinical trials and other clinical trials of our product candidates, fund any possible future product acquisitions, closing the NeuVax Phase 3 PRESENT study, and to augment its working capital and for general corporate purposes.

The Debenture carries an interest only period of six months to November 2016 following which the Purchaser shall have the rights, at its option, to require the Company to redeem up to $1,500,000 per month of the outstanding principal amount of the Amended Debenture. Interest is payable at the end of each month based on the outstanding principal. During the interest only period, the Company is permitted to satisfy such interest payments in kind by adding such amount to the outstanding principal.

The Company is required to promptly, but in any event no more than three trading days after the Purchaser delivers a redemption notice to the Company, pay the applicable redemption amount in cash or, at the Company’s election and subject to certain conditions, in shares of the Company’s common stock. If the Company elects to pay the redemption amount in shares of its common stock, then the shares will be delivered at the lesser of A) 7.5% discount to the average of the 3 lowest volume weighted average prices over the prior 20 trading days or B) a 7.5% discount to the prior trading day’s volume weighted average price. The Company may only opt for payment in shares of common stock if certain equity conditions are met. The Company, at its option, may also force the Purchaser to redeem up to double the monthly redemption principal amount of the Debenture but not less than the monthly payment. Among the various conditions that must be satisfied in order for the Company to be able to elect to satisfy the monthly redemption amounts in shares of its common stock, the minimum volume-weighted average price of the common stock was decreased from $0.75 to $0.20 per share in the Amended Debenture.

The Purchaser shall continue to have the right under the Debenture, commencing November 10, 2016, to require the Company to redeem the outstanding principal amount in cash, shares of the Company’s common stock or a combination thereof, except that the maximum monthly amount of such redemptions is $1,500,000; provided, that if the trading price of the Company’s common stock is at least $0.40 per share (as adjusted appropriately for stock splits, combinations or similar events) during such calendar month, then such monthly maximum redemption amount may be increased to $2,200,000 at the Purchaser’s election and if the Company has already elected to satisfy such redemptions in shares of common stock. In addition, notwithstanding the foregoing limitations on the monthly redemption amount, the Purchaser may elect up to three times in any 12-month period to increase the monthly maximum to $2,500,000.

The Purchaser can from time to time during the term of the Debenture require the Company to prepay in cash all or a portion of the outstanding principal plus accrued and unpaid interest (the “Outstanding Amount”) on written notice to the Company, provided, that such prepayment amount shall not exceed the lesser of $18,500,000 and the Outstanding Amount. In addition, the Company shall have the right to prepay in cash all (but not less than all) of the Outstanding Amount (1) at any time after November 10, 2017, or (2) upon a “change of control” (as such term is used un the Debenture), in each case with a 10% premium on the Outstanding Amount.

The Debenture provides that, following November 10, 2016, the Purchaser may elect to convert any portion of the Outstanding Amount into shares of common stock at a fixed price of $0.60 per share (as adjusted appropriately for stock splits, combinations or similar events).

Under the Debenture, the Company is required to maintain a minimum of the lesser of $18,500,000 of unencumbered cash or the Outstanding Amount in a restricted account as security for its obligations under the Debenture.

The Company’s obligations under the Debenture can be accelerated in the event the Company undergoes a change in control and other customary events of default. In the event of default and acceleration of the Company’s obligations, the Company would be required to pay all amounts of principal and interest then outstanding under the Amended Debenture in cash. The Company’s obligations under the Debenture are secured under a Security Agreement by a senior lien on all of the Company’s assets, including all of the Company’s interests in its consolidated subsidiaries.

Pursuant to the Purchase Agreement, on May 10, 2016, the Company issued to the Purchaser a Series A Common Stock Purchase Warrant (the “Series A Warrant”) to purchase 1,000,000 shares of the Company’s common stock at a price of $1.51 per share, maturing 5 years from issuance. Additionally, the Purchasers received a Series B Common Stock Purchase Warrant (the “Series B Warrant”) to purchase an additional 1,000,000 shares of common stock on June 29, 2016, the date of the Company’s public announcement of the interim analysis. The Series B Warrant is exercisable at a price of $0.43 per share. In accordance with the terms of the Amendment Agreement, the exercise price of the Series A Warrant was reduced to $0.43 per share (as adjusted appropriately

18

for stock splits, combinations or similar events). If the Purchaser elects such prepayment of the Debenture, then the number of shares subject to the Series A Warrant and Series B Warrant issued to the Purchaser will be reduced in proportion to the percentage of principal required and accrued interest to be prepaid by the Company.

In accordance with the NASDAQ Marketplace Rules, the Debenture continues to provide that the maximum number of shares of common stock that the Company is permitted to issue pursuant to the Amended Debenture is 36,185,586 shares, which amount represented approximately 19.99% of the Company’s outstanding common stock on May 10, 2016. However, the Company has agreed to seek stockholder approval to exceed such limitation in accordance with applicable NASDAQ rules.